mNo edit summary |

mNo edit summary |

||

| Line 8: | Line 8: | ||

: Feliz Ano Novo. | : Feliz Ano Novo. | ||

This being said, when thinking of | This being said, when thinking of which tone to pitch one's New Year Greetings with, I have to say the World's state of affairs still looks distressingly bad. The economy gives no hint that it will not crash nastily, being all the more a deplorable event that the so-called crisis is not an uncontrollable jolt of a complex system but a deliberate attack from the banksters on the people, dragging in its wake all that ugly that comes from money, from mere spoliation of society to the [[Blog:Fabrice/Ô_malheureux_mortels_!_Ô_terre_déplorable_!|worst conceivable crimes]]. | ||

Complex systems do have genuine uncontrollable jolts of their own, and in their always more daring attempt | Complex systems do have genuine uncontrollable jolts of their own, and in their always more daring attempt to secure a better control of the planet's wealth and of the mass of people through [https://en.wikipedia.org/wiki/The_Shock_Doctrine shock doctrine], the ruling elite—not that much the politicians who are the corrupt facade—but those in the closer rings of money, may finally give to ''Disaster Capitalism'' its literal meaning. | ||

So far however, everything would seem to go according to | So far however, everything would seem to go according to plan. ''"Man is a creature who can get used to anything, and [...] that is the very best way of defining him"'' wrote Dostoyevsky in the opening lines of ''Записки из Мёртвого дома''. This is true. People get used to money duress, to worse working conditions, to degradation, to reduced rights and increased surveillance and why, therefore, those who make money out of it would reverse or tamper the trend? Here and then, we even start to hear that the situation is on its way to recovery. Thus, while it is commonly accepted that the financial crisis is irrecoverable, the | ||

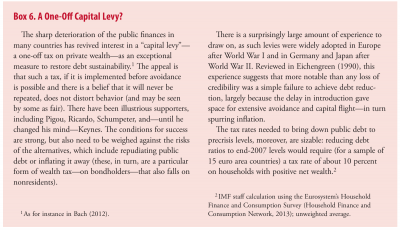

Shortly after the IMF "recommended", in October this year, a 10% tax on private wealth in a memo aptly titled "Taxing Times" <ref name="imf"><{{cite web|url= bring down public debt to | |||

precrisis levels|title=Fiscal Monitor - Taxing Times.}}</ref>, merely to ''bring down public debt to precrisis levels'', the EU kindly obliged and passed a "directive" in this sense, on December 12. | |||

<center><wz tagtotip="imfbox">[[Image:taxing-time-IMF-Oct2013.png|400px]]</wz></center> | |||

<span id="imfbox">Taxing Times: The IMF recommends a 10% capital levy ''on households with positive net wealth'' [...] ''before avoidance is possible''. Page 49 of Ref. <ref name="imf"/>.</span> | |||

The EU "deal" ("''deal''" is the word they use in the press release) is know as the "Bank Recovery and Resolution Directive" (BRRD), and is announced as a protection for the tax-payer, who will not be forced to bail-out the bank. Instead, the bank will be bailed-in, which means that the money will be taken directly from the tax-payers' savings instead. | |||

In passing, this is interesting to see how such a measure that is sure to send waves of people in the streets when it will strike, has been passed in the "parliament". This is taken care of by a so-called [http://europarltv.europa.eu/en/player.aspx?pid=772450bd-0a08-4555-8946-a18d00ef94b2 trilogue], which is the EU counterpart of [[Napoleon]]'s [https://en.wikipedia.org/wiki/French_Consulate consulate], that is, a trio to give the impression of shared responsibilities, of multiple involvement, in an organ that is in fact despotic (you can see the "trilogue" working on the BRRD [http://goo.gl/maqaCB here] and [http://goo.gl/5cWJbZ here]). | |||

[http://goo.gl/7Q3C7 The document itself] is, in contrast to the box of the IMF memo, a monstrous administrative text. But it comes with a plethora of companion documents, [http://goo.gl/7Ptx9 all listed in there], including a ''Citizens summary''. The latter document says very little, or says other things (e.g., the starting date is scheduled for the beginning of 2015 in the citizen version while the text itself refers to 2016). It is of coursed always painted as a positive move, a defense from the banking system and a strike to its malpractices. The seriousness of this can be confronted to the fact that the starting date, initially scheduled for 2018, has been advanced to 2016 at the demand of the European Central Bank <ref>{{cite web|url=http://goo.gl/HWFDge|name=Accord européen sur le renflouement des banques en difficulté.}}</ref>. I would extract the most relevant piece of text from the [http://goo.gl/7Ptx9 Statement by Commissioner Barnier]: | |||

:''The new rules provide authorities with the means to intervene decisively both before problems occur and early on in the process if they do. If, despite these preventive measures, the financial situation of a bank deteriorates beyond repair, the new law ensures that shareholders and creditors of the banks have to pay their share. If additional resources are needed, these will be taken from the national, prefunded resolution fund that each Member State will have to establish and build up so it reaches a level of 1% of covered deposits within 10 years.'' | |||

This is quite illustrative of how euphemisms are used to sell as a responsible and courageous policy a measure that most economists regard as pure robbery. Note also the built-in contradictions, since one wonders how the fund of "1% of covered deposits" to be "established and built up" by each Member State will be realized without involving the tax-payers, who are supposed to be those benefiting from this law (as tax-payers, while sufferings as bank creditors). Later on one finds that banks should participate to this fund, and the more-so the the more risks they take, but this only completes the panel of conman tricks since the lack of details or quantitative figures makes it pure speculation as to what it is supposed to mean. | |||

What it does really mean, on the other hand, is quite clear. People's deposit will be taxed, in a spirit very much similar to that which was experimented upon Cyprus. Finally, the acounts with less than 100.000€ were left untouched, and there is also such a close somewhere in the EU directive. But... | |||

* 100.000€ is not an obscene amount of money for dedicated savers with years of sparing behind them. What is obscene is people making this sort of money in a year, if not in a month or in a week, on this type of robbery. | |||

* Initially, there was no such limit in the Cypriot case and some say that the corresponding limit will not be able to be secured on the wider scale of the EU market. | |||

* Even if the threshold is assured, it is unfair that someone with 100.000€ will be left with 90.000€ while those who keep low profile at 99.000€ will be left untouched. | |||

* A deposit may not represent someone's personal wealth, but be part of the cash assets of a private small business, of an inheritance, of money collected or borrowed in view of acquiring a property (that would not be taxed if already bought). | |||

Well, I could carry on at length on why the whole approach is unfair, outrageous, nonsensical. But this is not even my point, rather, this is an illustration of the point. The economy, the spine of our society, is seriously ill and will most likely snap, resulting in an even more likely tragic : violence, crimes, rebellions of all sorts ranging from verbal abuse to physical aggression, lynching or summary executions, met by a corresponding spectrum from the police, ranging from arrests, beatings to people being shot. | |||

<ref>{{cite web|url=http://goo.gl/3P6uh5|title=Deal reached on bank “bail-in directive”}}</ref> | |||

<ref>{{cite web|url=http://goo.gl/HWFDge|title=Accord européen sur le renflouement des banques en difficulté}}</ref> | |||

<references/> | |||

Revision as of 21:25, 1 January 2014

Regardless of a gloomy situation and of everything bad that may/could/can/will happen, one has to strive to be happy, resolutely happy, hopelessly happy, I therefore wish to wish you (no pun intended) a Happy New Year.

To emphasize that, I'll put it apart and in the official languages of our little group:

- Feliz Año Nuevo.

- Bonne Année.

- С Новым Годом.

- Feliz Ano Novo.

This being said, when thinking of which tone to pitch one's New Year Greetings with, I have to say the World's state of affairs still looks distressingly bad. The economy gives no hint that it will not crash nastily, being all the more a deplorable event that the so-called crisis is not an uncontrollable jolt of a complex system but a deliberate attack from the banksters on the people, dragging in its wake all that ugly that comes from money, from mere spoliation of society to the worst conceivable crimes.

Complex systems do have genuine uncontrollable jolts of their own, and in their always more daring attempt to secure a better control of the planet's wealth and of the mass of people through shock doctrine, the ruling elite—not that much the politicians who are the corrupt facade—but those in the closer rings of money, may finally give to Disaster Capitalism its literal meaning.

So far however, everything would seem to go according to plan. "Man is a creature who can get used to anything, and [...] that is the very best way of defining him" wrote Dostoyevsky in the opening lines of Записки из Мёртвого дома. This is true. People get used to money duress, to worse working conditions, to degradation, to reduced rights and increased surveillance and why, therefore, those who make money out of it would reverse or tamper the trend? Here and then, we even start to hear that the situation is on its way to recovery. Thus, while it is commonly accepted that the financial crisis is irrecoverable, the

Shortly after the IMF "recommended", in October this year, a 10% tax on private wealth in a memo aptly titled "Taxing Times" [1], merely to bring down public debt to precrisis levels, the EU kindly obliged and passed a "directive" in this sense, on December 12.

Taxing Times: The IMF recommends a 10% capital levy on households with positive net wealth [...] before avoidance is possible. Page 49 of Ref. [1].

The EU "deal" ("deal" is the word they use in the press release) is know as the "Bank Recovery and Resolution Directive" (BRRD), and is announced as a protection for the tax-payer, who will not be forced to bail-out the bank. Instead, the bank will be bailed-in, which means that the money will be taken directly from the tax-payers' savings instead.

In passing, this is interesting to see how such a measure that is sure to send waves of people in the streets when it will strike, has been passed in the "parliament". This is taken care of by a so-called trilogue, which is the EU counterpart of Napoleon's consulate, that is, a trio to give the impression of shared responsibilities, of multiple involvement, in an organ that is in fact despotic (you can see the "trilogue" working on the BRRD here and here).

The document itself is, in contrast to the box of the IMF memo, a monstrous administrative text. But it comes with a plethora of companion documents, all listed in there, including a Citizens summary. The latter document says very little, or says other things (e.g., the starting date is scheduled for the beginning of 2015 in the citizen version while the text itself refers to 2016). It is of coursed always painted as a positive move, a defense from the banking system and a strike to its malpractices. The seriousness of this can be confronted to the fact that the starting date, initially scheduled for 2018, has been advanced to 2016 at the demand of the European Central Bank [2]. I would extract the most relevant piece of text from the Statement by Commissioner Barnier:

- The new rules provide authorities with the means to intervene decisively both before problems occur and early on in the process if they do. If, despite these preventive measures, the financial situation of a bank deteriorates beyond repair, the new law ensures that shareholders and creditors of the banks have to pay their share. If additional resources are needed, these will be taken from the national, prefunded resolution fund that each Member State will have to establish and build up so it reaches a level of 1% of covered deposits within 10 years.

This is quite illustrative of how euphemisms are used to sell as a responsible and courageous policy a measure that most economists regard as pure robbery. Note also the built-in contradictions, since one wonders how the fund of "1% of covered deposits" to be "established and built up" by each Member State will be realized without involving the tax-payers, who are supposed to be those benefiting from this law (as tax-payers, while sufferings as bank creditors). Later on one finds that banks should participate to this fund, and the more-so the the more risks they take, but this only completes the panel of conman tricks since the lack of details or quantitative figures makes it pure speculation as to what it is supposed to mean.

What it does really mean, on the other hand, is quite clear. People's deposit will be taxed, in a spirit very much similar to that which was experimented upon Cyprus. Finally, the acounts with less than 100.000€ were left untouched, and there is also such a close somewhere in the EU directive. But...

- 100.000€ is not an obscene amount of money for dedicated savers with years of sparing behind them. What is obscene is people making this sort of money in a year, if not in a month or in a week, on this type of robbery.

- Initially, there was no such limit in the Cypriot case and some say that the corresponding limit will not be able to be secured on the wider scale of the EU market.

- Even if the threshold is assured, it is unfair that someone with 100.000€ will be left with 90.000€ while those who keep low profile at 99.000€ will be left untouched.

- A deposit may not represent someone's personal wealth, but be part of the cash assets of a private small business, of an inheritance, of money collected or borrowed in view of acquiring a property (that would not be taxed if already bought).

Well, I could carry on at length on why the whole approach is unfair, outrageous, nonsensical. But this is not even my point, rather, this is an illustration of the point. The economy, the spine of our society, is seriously ill and will most likely snap, resulting in an even more likely tragic : violence, crimes, rebellions of all sorts ranging from verbal abuse to physical aggression, lynching or summary executions, met by a corresponding spectrum from the police, ranging from arrests, beatings to people being shot.

- ↑ 1.0 1.1 <[bring down public debt to precrisis levels Fiscal Monitor - Taxing Times.]

- ↑ http://goo.gl/HWFDge

- ↑ Deal reached on bank “bail-in directive”

- ↑ Accord européen sur le renflouement des banques en difficulté